KSeF

What is the National e-Invoice System?

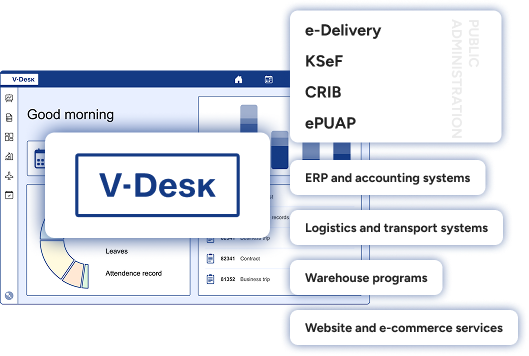

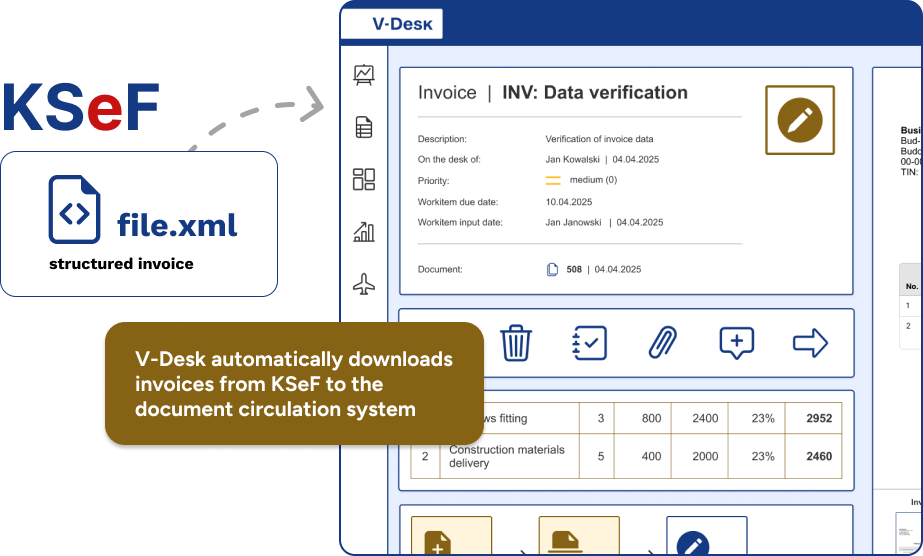

The National e-Invoice System (KSeF) enables structured invoices to be issued and made available. The integration of the V-Desk System with KSeF frees the entrepreneur from the need to technically handle invoices and prepare them in the appropriate structured format and validates the technical and business correctness of the invoices sent and received.

What business processes will the combination of KSeF and V-Desk facilitate?

1

Converting invoices to the required structure in KSeF

Thanks to the system’s built-in mechanisms, invoices are automatically converted to the required structure and the data completes itself.

2

Invoice data completeness check

Before the invoice is sent, the document’s structure is validated and its business case verified.

3

Guarantee of delivery of invoices in case of unavailability of KSeF

The V-Desk download and transfer process has been equipped with a mechanism to guarantee the delivery of the invoice in case KSeF is unavailable.

4

Strict control over processed data

V-Desk offers unlimited comparison and reporting possibilities. It provides ready-made, customised sales invoice reports for further posting.

5

Transfer of an accounting document into the workflow

A defined connection to KSeF ensures that the document is transferred to the document workflow used and possibly exported to the financial and accounting system.

6

Support for invoice attachments

in V-Desk

The V-Desk download and transfer process has been equipped with a mechanism to guarantee the delivery of the invoice in case KSeF is unavailable.

KSeF in V-Desk and V-Desk GA

The KSeF module is an add-on to the Invoices module and is available in both V-Desk implementation models. It can be configured in a dedicated version of the V-Desk system and can also be selected from the ready-made V-Desk GA processes.

What do you gain by choosing to combine KSeF with V-Desk?

Optimisation of the invoice workflow process

Saving staff time

Efficient communication with the KSeF platform

Secure archiving of documents

Elimination of duplicate invoices

Data collected in summaries

and reports

We integrate the KSeF into the V-Desk without programming

The integration of the National e-Invoice System into V-Desk does not require the involvement of the IT department. In addition, as a provider of a business process management platform, we constantly ensure that the products we offer are adapted to market changes as well as any legislative changes.