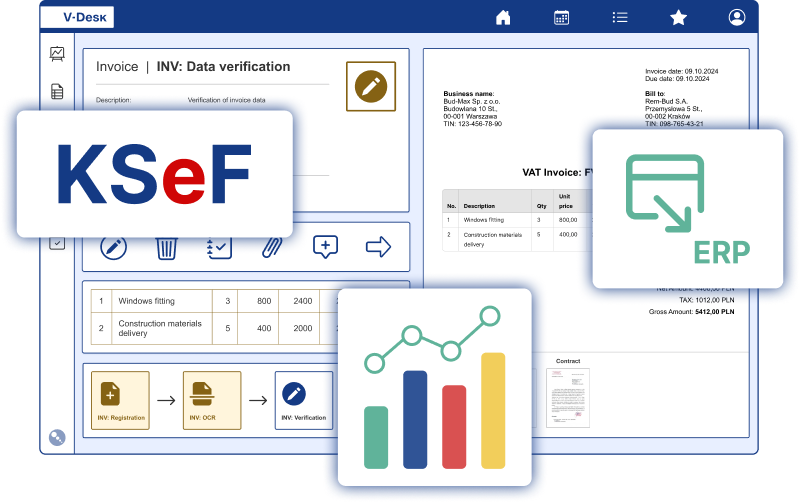

Accounts payable and invoice management

V-Desk is the ideal tool for streamlining your organisation’s invoice and accounts payable processes. In a single system, you can plan your company’s invoice workflow, integration with the National e-Invoice System (KSeF), monitor the payment status of invoices issued and manage fixed assets. You can additionally control and analyse all these processes with the intelligent Power BI tool.

Modules for invoicing and AP

in V-Desk and V-Desk GA

invoices

Electronic invoice workflow is the process of converting a document from paper to digital and its onward flow within an organisation.

KSeF

The V-Desk is connected to the National e-Invoice System. It sends and receives structured invoices from KSeF.

Power BI

An analytical knowledge base to support strategic decision-making, both for managers and every employee.

Payment files

The Payment Files application enables mass preparation of domestic and international transfer batches, ensuring efficiency, accuracy, and compliance in payment processing.

DORA

V-Desk supports financial sector organizations in meeting the obligations imposed by the DORA regulation, providing tools for ICT risk management, monitoring of external service providers, and DORA-compliant reporting.

Debt collection

Invoice recovery is a process that enables recovery actions to be carried out in the shortest possible time.

Full digitalisation of business processes at your fingertips.

More than 200,000 satisfied V-Desk users have taken advantage of this opportunity.

From invoice to payment

Many organizations implement electronic invoice processing, but only a well-designed “from receipt to payment” process truly eases the accounting workload and clarifies responsibilities. Below, we describe a sample scenario that you can adapt to your organization’s structure (branches, cost centers, projects, multi-level approvals, substitutions).

1. Document registration and data completeness

The invoice enters the system via email, scan, or as a structured document through KSeF integration. From the start, you can define which fields are required (e.g., vendor, tax ID, amount, payment due date, cost center, purchase order number, project). This minimizes documents lacking key information and reduces clarifying correspondence.

2. Substantive verification and purchase compliance

The document is automatically routed to the appropriate people (e.g., budget owner, project manager, or procurement department). The process can support compliance checks with purchase orders and receipts (three-way matching: invoice–order–delivery note/protocol). In practice, this means fewer errors, fewer corrections, and a clear decision trail.

3. Financial approval and risk control

On the accounting side, the process includes formal correctness checks, tax qualification, and assignment to the appropriate accounts and registers. Workflow rules allow adding control stages (e.g., amount thresholds, exceptional paths for leases or fixed assets) and managing substitutes during vacation periods.

4. Payment preparation and status monitoring

Once the document is approved, you can generate payment batches through payment files. This can be done in bulk, with separation by currency and due date. The system simultaneously maintains statuses (to be paid / paid / overdue), facilitating communication with the business and supporting collections for sales invoices.

5. Reporting and analysis in Power BI

Once the process is standardized, data starts working for the company. Reporting in Power BI allows you to analyze approval times, invoices in the queue, bottlenecks, values broken down by cost center/project, or payment timeliness. It’s a quick way to move from “firefighting” to consciously managing cash flow and team workload.

Invoices and accounting in V-Desk are

Saving time

when registering accounting documents.

Secure storage of

information on assets and financial history.

A shortened process

acquisition and processing of organisational data

How does V-Desk streamline invoicing and accounts payable management?

With the V-Desk system, you can come up with any invoice workflow that is perfectly tailored to your organisation’s needs.

Electronic invoice collection allows you to automatically monitor the payment status of your invoices. In the V-Desk system, you can come up with any invoice workflow that is perfectly tailored to your organisation’s needs.

The electronic fixed asset register makes it easy and transparent to keep a record of the equipment owned by the company.